ECB publishes legal framework for the Eurosystem Collateral Management System (ECMS)

RegCORE Client Alert | Banking Union | Capital Markets Union | Eurosystem monetary policy

QuickTake

On 14 August 2024, the European Central Bank (ECB) published harmonised rules and arrangements for the mobilisation and management of collateral in Eurosystem credit operations. The new rules will take effect with the launch of the Eurosystem Collateral Management System (ECMS), which was scheduled to start on 18 November 2024 and on 25 September 2024 was rescheduled (again) for the “…first half of 2025. The exact launch data will be communicated in October 2024.”Details available here.Show Footnote

The ECMS is part of the ECB’s Vision 2020 which was launched in 2015 and preparatory work on ECMS beginning in December 2017 and was supposed to start 8 April 2024. On 30 November 2023Details available here.Show Footnote that date was moved to 18 November 2024 and now is being rescheduled again to “…support national central banks of the euro area and the counterparties that will be joining the ECMS by enabling them to achieve sufficient testing coverage in a stable environment to ensure their readiness by the revised go-live date.” Besides that rescheduling the ECMS’ set-up remains the same as discussed in the previous published version of this Client Alert. When ECMS launches, it will be truly transformative by creating one central point one set of procedures and one platform to manage all collateral. The ECMS thus is not only good for the ECB’s activity but also the EU’s on-going efforts towards completing the EU’s Capital Markets Union (CMU).

The ECB’s Vision 2020, first announced in 2015, was an ambitious plan aimed at enhancing the Eurosystem’s financial market infrastructure and ensuring its readiness to face new challenges and opportunities in the financial landscape. This vision encompassed several key initiatives, including the consolidation of TARGET2 and T2S (TARGET2-Securities), and the development of new services such as the TARGET Instant Payment Settlement (TIPS) and the ECMS. Once the ECMS goes live, connection with it and all TARGET Services will be via the Eurosystem Single Market Infrastructure Gateway (ESMIG). Counterparties can either connect directly to the ECMS via ESMIG or use third-party technical access.

According to Article 18.1 of the ECB Statute, all Eurosystem credit operations conducted with credit institutions and market participants are based on the mobilisation of adequate collateral.ECB, Collateral Management in Eurosystem Credit Operations: Information for Eurosystem Counterparties, available here.Show Footnote This means that eligible Eurosystem counterparties can only obtain liquidity from the national central bank (NCB) of their home Member State if “marketable assets” and/or “non-marketable assets” that fulfil the Eurosystem’s eligibility criteria (as set out in the ECB’s General Documentation on Eurosystem monetary policy instruments and procedures” (the GD)) are provided as collateral.The GD provides a comprehensive set of guidelines and procedures for the monetary policy operations conducted by the Eurosystem, which comprises the ECB and the NCBs of the Member States whose currency is the euro. The GD specifies the eligibility criteria for counterparties and collateral. Counterparties must meet certain standards to participate in Eurosystem monetary policy operations, and the collateral they provide must meet specific eligibility criteria to ensure that the risks associated with monetary policy operations are properly managed.Show Footnote

Against this background and in order to improve the operational efficiency and transparency of Eurosystem procedures related to the mobilisation and management of collateral, the new rules aim to harmonise the way in which NCBs should manage collateral provided by eligible counterparties in Eurosystem credit operations. Notably, this is to be achieved via standardised and operationally uniform processes, regardless of the location of the collateral or counterparty.These are introduced via the ECMS, the General Documentation Guideline (ECB/2014/60) which has been amended (available here) to take account of Guideline on the Management of Collateral in Eurosystem credit operations (ECB/2024/22), available here.Show Footnote The ECMS is thus a unified system for managing assets provided as collateral in Eurosystem credit operations and is set to replace the 20 individual collateral management systems belonging to the euro area NCBs.For more details, see here.Show Footnote

Key takeaways

The credit operations which the Eurosystem carries out can be categorised as follows: (i) liquidity-providing reverse transactions (i.e., liquidity-providing Eurosystem monetary policy operations excluding foreign exchange swaps for monetary policy purposes and outright purchases); (ii) intraday credit operations (i.e., intraday credit in TARGET Services i.e. T2 and T2S auto-collateralisations); and (iii) Enhanced Contingency Solution (ECONS).ECB, Collateral Management in Eurosystem Credit Operations: Information for Eurosystem Counterparties, available here.Show Footnote

Participation in the Eurosystem’s credit operations requires a counterparty to fulfil the Eurosystem’s counterparty eligibility criteria. This means that each counterparty may be eligible to participate in either all or some of the categories of the Eurosystem credit operations.Fine-tuning operations (executed by means of quick tender procedures), counterparties are selected in accordance with Article 57 of the General Documentation setting out the participation criteria.Show Footnote In other words, monetary policy counterparties may participate in some or all Eurosystem credit operations whereas intraday credit counterparties have access to intraday credit only.

As mentioned above, eligible counterparties may only obtain credit from their home Member State NCB. In the case of marketable assets, used as collateral, however, eligible assets may be issued in any European Economic Area (EEA) country while eligible non-marketable assets underlying a Eurosystem credit claim may be governed by the law of any Member State whose currency is the euro, provided that the overall number of laws governing the claim does not exceed two.ECB, Collateral Management in Eurosystem Credit Operations: Information for Eurosystem Counterparties, available here.Show Footnote

This is the background against which the Eurosystem has put in place the bespoke collateral management system and arrangements, allowing for all marketable and non-marketable eligible assets to be made available to all counterparties, regardless of where the assets or counterparties are situated. The ECMS is thus set to operate as the single Eurosystem platform used by the euro area NCBs for managing eligible assets and cash mobilised as collateral in Eurosystem credit operations.

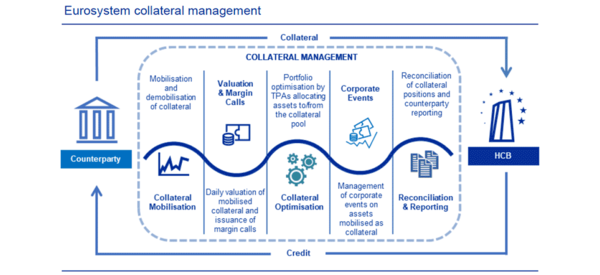

Figure 1 – ECB: Eurosystem collateral management (simplified overview) ECB, Collateral Management in Eurosystem Credit Operations: Information for Eurosystem Counterparties, available here.Show Footnote

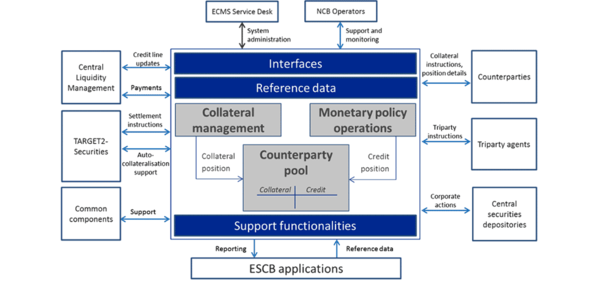

Operationally the ECMS tracks NCBs’ counterparties’ collateral and credit positions. ECMS calculates counterparty credit lines and delivers them to the central liquidity management tool. After mobilisation, counterparties send settlement instructions to T2S for settlement. Corporate actions, triparty instructions and mobilisation of credit claims are harmonised and standardised by the ECMS. The ECMS tracks NCBs’ counterparties’ individual collateral and credit positions. Data from central securities depositories, triparty agents, and ECB/Eurosystem databases and applications is used and the ECMS calculates counterparty credit lines and delivers them to the central liquidity management tool.

Figure 2 – ECB: ECMS operational flows Available here.Show Footnote

Operationally, migration to ECMS is set to take a “big bang” approach as part of its go-live. As the ECB states (certainly as part of the original planned start):

“This means that all interaction related to collateral management between national central banks and their communities (counterparties, central securities depositories and triparty agents) will be carried out using the ECMS from the migration date onwards.

Relevant collateral and credit positions will also be transferred from national central banks’ systems and made available in the ECMS from that date.

National central banks’ communities may also need to adapt their systems to be ready to use the ECMS. National central banks will conduct testing activities with their communities before the launch to ensure that they are ready to migrate to the new system. Further information on the ECMS’ functionalities will be provided at the appropriate time.

The ECB has published a Business Description Document, Info Pack and other technical documentation to assist counterparties, central securities depositories and triparty agents in adapting their systems.

The new system will not alter existing business and legal relationships between counterparties and national central banks – counterparties, central securities depositories and triparty agents will still contact their usual interlocutors at the relevant national central bank, and national central banks will continue to collect counterparties’ bids in Eurosystem credit operations.

The Market Infrastructure Board, the management body responsible for the ECMS project, has mandated an internal Eurosystem working group to represent future ECMS users throughout the realisation phase.”

The ECB’s amendments to the GD will, with the launch of ECMS mean the newly harmonised rules provide the legal basis on which ECMS will operate. These now newly harmonised rules and arrangements for the mobilisation and management of collateral in Eurosystem credit operations reflect in particular:

- The adoption of market standards relevant for Eurosystem collateral management, as set out in the Single Collateral Management Rulebook for Europe (SCoRE);

- Updates to the eligibility criteria applicable to securities settlement systems (SSSs), links between SSSs and triparty agents (TPAs);

- The implementation of a single operational method – pooling – for maintaining collateral mobilised by Eurosystem counterparties; and

- The adoption of a harmonised approach for recovering external costs charged by central securities depositories (CSDs) and TPAs from counterparties.

The GD has been amended relating to:

- The prioritisation of credit assessments from the national central banks’ in-house credit assessment systems (ICASs), where available, over those from other credit assessment systems for the provision of credit assessment of debtors and guarantors of credit claims used to determine the eligibility of the credit claim and the applicable valuation haircuts;

- The Eurosystem credit assessment framework (ECAF) with regard to the acceptance of local currency and foreign currency ratings from external credit assessment institutions (ECAIs); and

- The expression in face amount (FAMT) of the quantity of debt instruments to be eligible as collateral and comply with market standards for the denomination of securities.

By harmonising collateral management and promoting EU financial integration, the ECMS should benefit the Eurosystem, its counterparties, and the market overall. Most importantly, the ECMS supports multi-pooling functionality that allows counterparties to hold collateral pools in the ECMS in multiple locations therefore giving counterparties much greater flexibility in their global collateral management. That being said, some non-marketable assets, such as certain credit claims, will still be recorded at the NCB level but ECMS will be updated to provide an overall accurate position.

Outlook and next steps

The ECB’s publication of harmonised rules and arrangements for the mobilisation and management of collateral in Eurosystem credit operations signifies a major advancement in the pursuit of delivering on the ECB’s “Vision 2020”, the ECB’s monetary policy and financial integration overall. Market participants should note the prioritisation of credit assessments from NCB’s in-house systems over other credit assessment systems, adjustments to the Eurosystem credit assessment framework for local and foreign currency ratings and the standardisation of the expression in FAMT for debt instruments.

As the ECMS replaces individual collateral management systems, eligible counterparties must prepare for this transition by reviewing updated eligibility criteria, understanding new means of engagement via ESMIG and ensuring systems compatibility. Some market participants, may want to step up their completion of

- a strategic review of their internal systems and processes to assess readiness for ECMS integration. This includes evaluating the compatibility of their IT infrastructure with the ESMIG and understanding the technical specifications provided by the ECB. It is crucial to engage in testing activities with NCBs to identify and rectify any potential issues before the “big bang” migration of ECMS’ go-live;

- familiarising themselves with the pooling method for maintaining collateral, the harmonised approach for recovering external costs, and the prioritisation of credit assessments from NCBs’ ICASs. Training sessions for staff on these new processes will be vital to ensure that all team members (including in-house transactional lawyers) are well-versed in the updated procedures;

- review the changes to the legal framework governing the mobilisation and management of collateral in Eurosystem credit operations. This includes amendments to the GD and the adoption of market standards as set out in the SCoRE. In-House legal teams should update internal policies and procedures to align with these new requirements; and

- maintaining/deepening open lines of communication with relevant NCBs and participating in industry forums to share insights and best practices. Collaboration with peers can provide valuable perspectives on navigating the transition to ECMS.

Overall, the new harmonised rules and the introduction of the ECMS represent a pivotal shift towards a more integrated and efficient European financial market. Market participants are advised to diligently align their practices with these new rules to fully benefit from the enhanced operational framework.

About us

PwC Legal is assisting a number of financial services firms and market participants in forward planning for changes stemming from relevant related developments. We have assembled a multi-disciplinary and multijurisdictional team of sector experts to support clients navigate challenges and seize opportunities as well as to proactively engage with their market stakeholders and regulators.

Moreover, in addition to AI-powered solutions focusing on contractual repapering to meet DORA compliance we have developed a number of RegTech and SupTech tools for supervised firms. This includes PwC Legal’s Rule Scanner tool, backed by a trusted set of managed solutions from PwC Legal Business Solutions, allowing for horizon scanning and risk mapping of all legislative and regulatory developments as well as sanctions and fines from more than 1,500 legislative and regulatory policymakers and other industry voices in over 170 jurisdictions impacting financial services firms and their business.

Equally, in leveraging our Rule Scanner technology, we offer a further solution for clients to digitise financial services firms’ relevant internal policies and procedures, create a comprehensive documentation inventory with an established documentation hierarchy and embedded glossary that has version control over a defined backward plus forward looking timeline to be able to ensure changes in one policy are carried through over to other policy and procedure documents, critical path dependencies are mapped and legislative and regulatory developments are flagged where these may require actions to be taken in such policies and procedures.

The PwC Legal Team behind Rule Scanner are proud recipients of ALM Law.com’s coveted “2024 Disruptive Technology of the Year Award”.

If you would like to discuss any of the developments mentioned above, or how they may affect your business more generally, please contact any of our key contacts or PwC Legal’s RegCORE Team via de_regcore@pwc.com or our website.